Outliving your Spouse

The Crucial Role of Financial Representatives in Retirement

Posted by Morgan Fisher

Serving Cedar Rapids, Iowa, and Surrounding Areas.

The sobering reality for many married couples is that eventually, one spouse will outlive the other. This not only brings about emotional adjustments but also significant financial considerations. Understanding how taxes impact your financial situation after losing a spouse is crucial for managing your finances effectively during this transition.

Tax Treatment for Married Couples

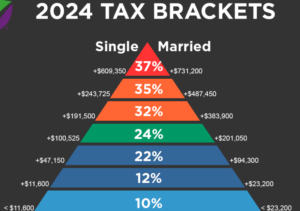

The tax code offers more favorable treatment to married couples compared to single filers. For instance, a married couple filing jointly with an income of $250,000 in 2024 falls into the 24% marginal tax bracket. In contrast, the same income for a single filer places them in the 35% marginal tax bracket—a substantial 11% increase. The tax bracket pyramid for 2024 illustrates the threshold differences between married and single filers.

Changes in Income Sources

Following the loss of a spouse, several income sources may undergo changes. For married couples receiving Social Security, payments are typically based on each spouse’s working history or spousal benefit. However, when one spouse passes away, the surviving spouse receives the higher of the two benefits, provided they qualify. It’s important to note that up to 85% of Social Security benefits can be taxable if your individual return’s “combined income” exceeds $25,000 (compared to $32,000 for married couples).

Other fixed income sources like pensions or annuities may also see adjustments based on ownership and the presence of spousal benefits. Many pensions or annuities include a spousal benefit, ensuring continued payments at either the same level or a percentage thereof (e.g., a 50% spousal benefit would provide half the previous income).

In community property states, jointly held taxable investment accounts receive a full step-up in basis, while in non-community property states, this step-up is 50%. Delaying the sale of significantly appreciated investments can lead to substantial savings in capital gains taxes due to this step-up provision.

Unchanged Income Sources

Certain income sources remain unaffected, particularly concerning inherited retirement accounts. Assuming the surviving spouse inherits retirement accounts, they become subject to required minimum distributions (RMDs) for the entire balance once they reach the age where RMDs are mandatory (currently 73). However, there may be opportunities to reduce RMD amounts by rolling funds into their own IRA if they are younger.

Despite reductions in some income sources and potential RMD amount reductions, many individuals may find themselves in a higher tax bracket once they are single—and sometimes significantly so. Analyzing how your tax situation could be impacted by this change can lead to tax planning opportunities. Examples include Roth conversions and Qualified Charitable Distributions, allowing intentional tax management while benefiting from more favorable tax rates.

Key Takeaways

Navigating the financial implications of losing a spouse requires thorough planning and understanding of how different income sources and tax consequences shift. By proactively exploring tax-efficient strategies and seeking professional advice, individuals can mitigate financial challenges and ensure their long-term financial stability during this challenging period.

Investment advisory services are offered through Fusion Capital Management, an SEC registered investment advisor. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration is not an endorsement of the firm by the commission and does not mean that the advisor has attained a specific level of skill or ability. All investment strategies have the potential for profit or loss.